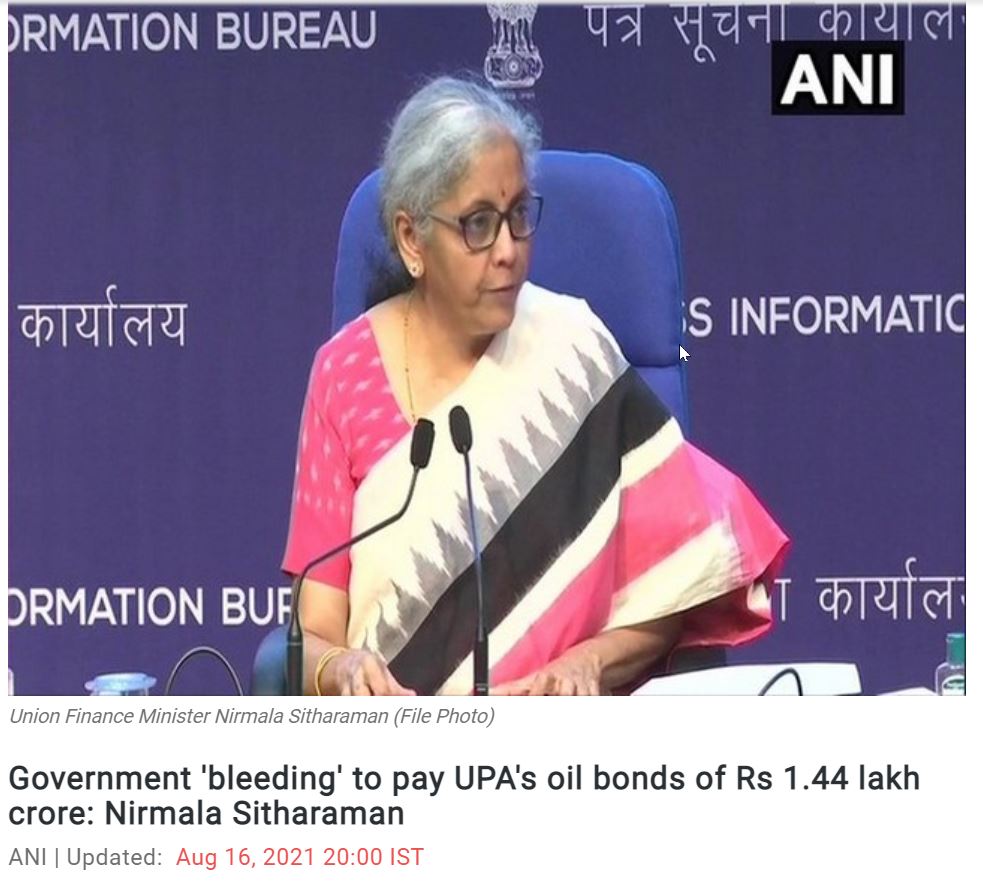

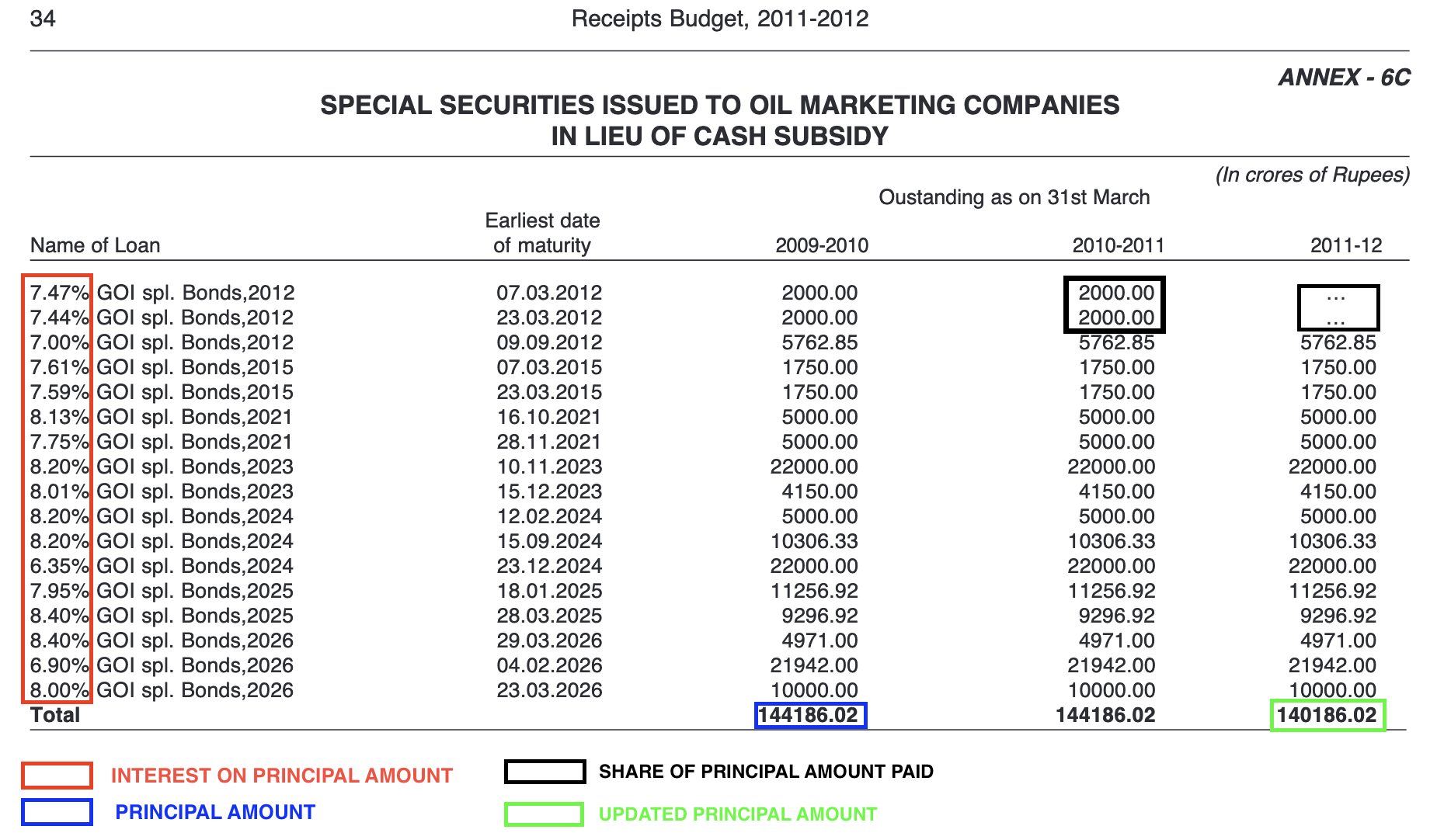

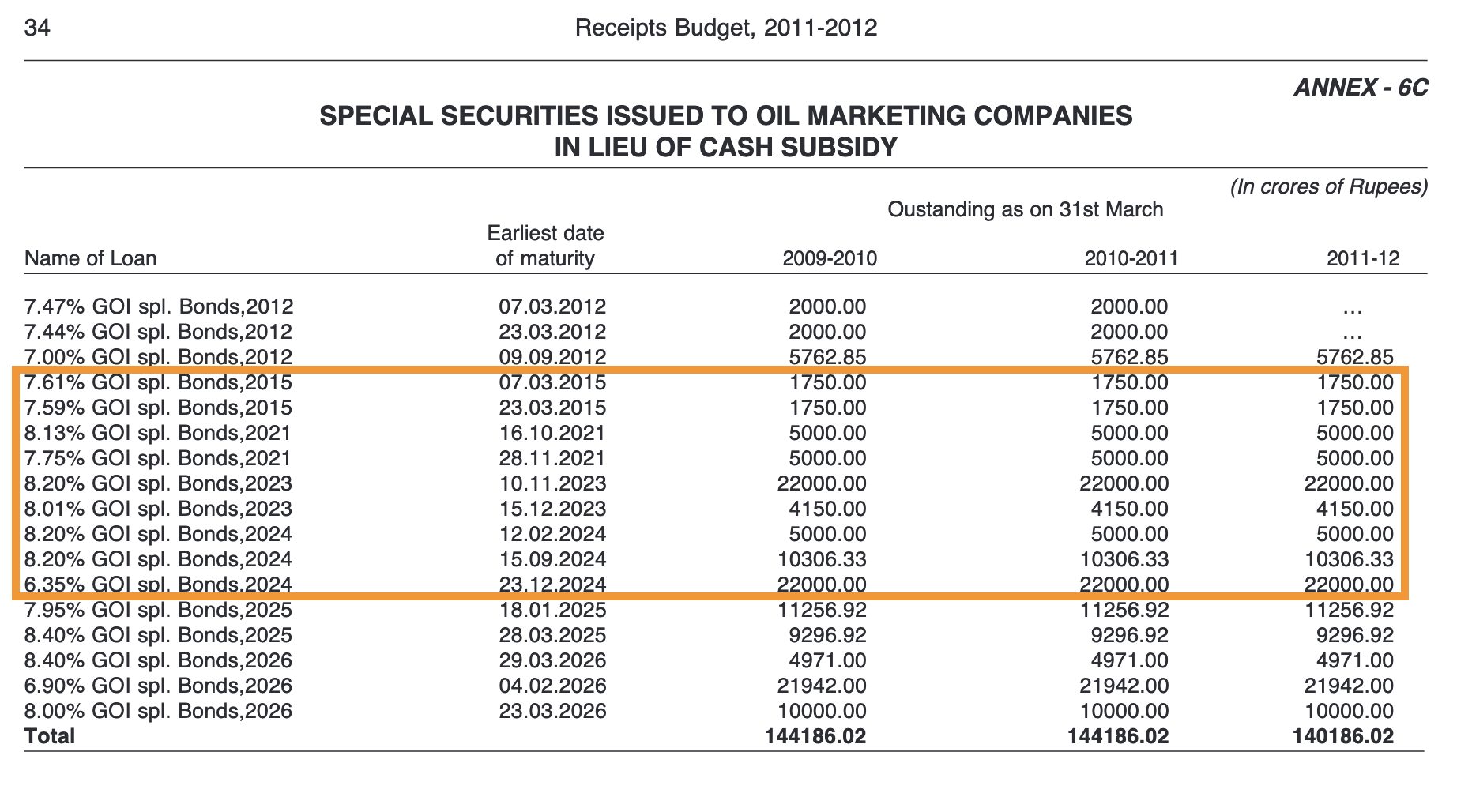

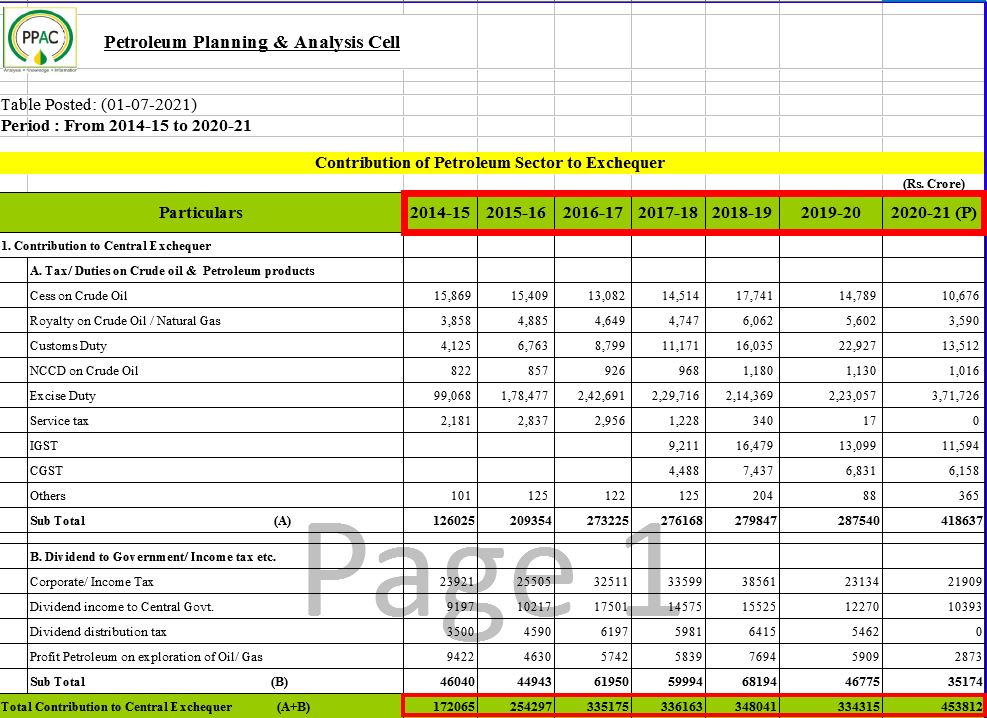

Archit Mehta posted: "On August 16, while responding to queries by the media on the ongoing issue of soaring fuel prices, Union Finance Minister Nirmala Sitharaman claimed, "UPA government had reduced fuel prices by issuing oil bonds of ₹1.44 lakh crore. I can't go by the tric"

|

| |